For many people, the idea of “making a budget” brings up stress or guilt. But budgeting isn’t about restriction—it’s about clarity and freedom. When you understand where your money is going, you gain the power to make better choices, reduce financial anxiety, and set yourself up for long-term success.

In Utah especially—where living costs vary widely across counties, and seasonal expenses can shift dramatically—having a clear budget is one of the smartest financial decisions you can make. Whether you’re preparing for homeownership, managing a growing family, or simply trying to stretch your paycheck further, a monthly budget can make all the difference.

This guide breaks budgeting into simple steps, using insights inspired by UIB’s community-focused financial education programs.

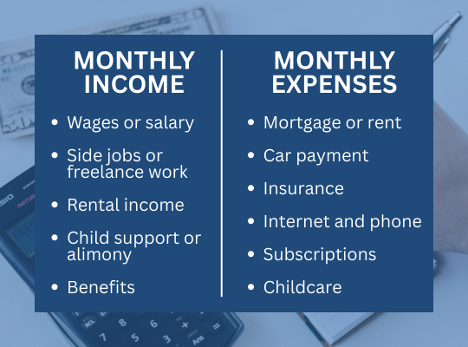

Step 1: Identify Your Monthly Income

The first step toward budgeting success is knowing exactly how much money you bring in each month. This includes:

- Wages or salary

- Side jobs or freelance work

- Rental income

- Child support or alimony

- Benefits

If your income fluctuates, calculate a three-month average or base your budget on your lowest expected month. This creates more stability and helps prevent overspending.

Step 2: List All Your Monthly Expenses

Your expenses fall into two main categories: fixed and variable.

Fixed Expenses

These are predictable and stay the same month after month:

- Mortgage or rent

- Car payment

- Insurance

- Internet and phone

- Subscriptions

- Childcare

Variable Expenses

These change depending on habits, usage, or lifestyle:

- Groceries

- Fuel

- Dining out

- Entertainment

- Clothing

- Household items

Step 3: Set Clear Financial Goals

A budget works best when it’s tied to specific goals. Instead of thinking, “I need to save more,” focus on exact targets, such as:

- Save $3,000 for emergencies

- Pay off $5,000 in credit card debt

- Build a down payment fund

- Create a holiday fund

- Start contributing toward retirement

When you know why you’re budgeting, you're far more likely to stick with it.

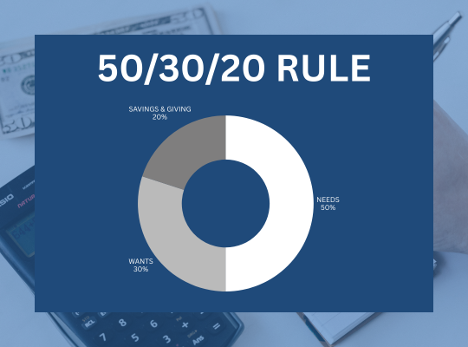

Step 4: Use the 50/30/20 Rule as a Foundation

A great beginner-friendly structure is the 50/30/20 rule:

- 50% Needs – housing, groceries, utilities, insurance, transportation

- 30% Wants – dining out, hobbies, entertainment

- 20% Savings & Debt Repayment – emergency fund, retirement, financial goals

You may need to adjust these percentages depending on your Utah region. For example, housing costs in northern Utah may require shifting percentages to stay realistic.

Step 5: Track Your Spending Throughout the Month

This is where budgeting becomes powerful. A budget isn’t something you create once—it’s something you actively use.

You can track spending through:

- A budgeting app

- A spreadsheet

- Paper and pen

- Your UIB online banking dashboard

One of the most effective habits is doing a weekly 5-minute money check-in. It keeps you aware of spending patterns and helps prevent overspending before it even happens.

Step 6: Build an Emergency Fund

Even small emergencies—car repairs, appliances breaking, medical bills—can seriously impact your finances if you're not prepared. That’s why every good budget includes an emergency fund.

Your ideal long-term goal is 3–6 months of essential expenses, but starting small is absolutely fine. Even $25 or $50 a month builds a foundation.

Whether your goal is small or large, steady consistency wins.

Step 7: Review and Adjust Each Month

A budget isn’t a rigid rule—it’s a living tool. That means it should shift as your life changes.

At the end of each month, take a moment to:

- Review what worked

- Identify overspending trends

- Adjust categories

- Revisit goals

- Celebrate progress

Every month you budget, you build stronger financial awareness and discipline. It’s a long-term skill that pays off for life.

Utah-Specific Budgeting Tips

1. Prepare for Seasonal Costs

Utah has dramatic seasonal shifts—snowstorms, summer travel, outdoor recreation, and holiday spending all impact your budget. Creating “sinking funds” helps spread these costs throughout the year.

2. Monitor Utility Changes

Regions like Central and Southern Utah can see significant seasonal fluctuations in energy bills. Planning helps these expenses feel manageable rather than stressful.

3. Account for Property-Related Fluctuations

Property taxes and home maintenance may vary annually. Including small monthly contributions prevents surprises.

How UIB Helps You Budget More Effectively

UIB offers several financial tools that make creating and following a budget easier, including:

- Online banking

- Automatic transfers to savings

- Balance alerts

- Local customer support

- Financial education resources

These resources make it simple to take what you've learned and apply it immediately. Learn more here.

Conclusion: A Budget That Works Is a Budget You Can Stick To

A successful budget isn’t about perfection—it’s about consistency. When you create a realistic plan, track it regularly, and adjust it to match your life, budgeting becomes empowering instead of limiting.

Whether you're focused on saving for big goals, reducing financial stress, or simply gaining more clarity around your spending, a thoughtful monthly budget gives you control. With practical tools, community support, and expert financial education, UIB is here to help you take confident steps toward financial freedom.

Disclaimer: The views and opinions expressed in this post do not necessarily reflect the official policy or position of Utah Independent Bank. This post is intended for entertainment and/or informational purposes only and should not be construed as financial advice or an endorsement of any product or service.