As a parent in Utah, you’re teaching your teen so many life skills: how to drive, the importance of hard work, and maybe even how to navigate our beautiful mountains. But are you preparing them for one of the most crucial journeys of all, the path to financial independence?

True financial freedom isn't about how much money you have; it's about the confidence and knowledge to manage it wisely. This journey begins with a solid foundation in financial literacy, and there's no better time to start than the teenage years. It’s about transforming abstract concepts into real-world skills that will serve them for a lifetime.

Let’s explore practical steps you can take to equip your teen for a prosperous future.

Start with the "Why": The Cornerstone of Financial Literacy

Before diving into bank accounts and budgets, have a conversation about the purpose of money. Frame it not as a source of stress, but as a tool for achieving goals. Whether it's saving for a car, a college laptop, or a future apartment, connecting money to their personal aspirations makes the lessons relevant and engaging.

Core Principles to Discuss with Your Teen

Earning

Money is received in exchange for value, whether from a part-time job, chores, or entrepreneurial ventures.

Saving

Delaying gratification today to meet a bigger goal tomorrow.

Spending

Making conscious choices about where their money goes.

Giving

The importance of using resources to help others, fostering a healthy relationship with money.

This foundational financial literacy is the bedrock upon which all other money skills are built.

The Power of a Real-World Tool: Teen Checking Accounts

The leap from a piggy bank to a formal bank account is a significant milestone. It’s where theory meets practice. For teenagers, a dedicated teen checking account is the perfect training ground.

Unlike a standard account, a teen checking account is specifically designed for young adults learning the ropes, typically with you as a joint account holder. This allows for guided independence. They have the freedom to manage their money, while you have the oversight to help them avoid missteps.

What to Look For in a Teen Checking Account in Utah

When choosing a teen checking account in Utah, look for features that support learning:

No or low monthly fees

You do not want their hard-earned savings eroded by fees.

Robust mobile banking and alerts

Teens live on their phones. An intuitive app allows them to check balances, transfer money, and set up alerts for low balances or transactions, keeping them engaged and informed.

ATM access

Convenient access to cash teaches them about withdrawal limits and potential fees.

Debit card

A first debit card is a powerful lesson in plastic money. It is safer than cash and provides a clear record of spending, which is essential for budgeting.

At Utah Independent Bank, our youth banking Utah programs, including our Teen Checking Account, are built with this educational philosophy in mind. We provide the tools and security for teens to learn by doing, all within the safety of your guidance.

Budgeting: The Blueprint for Financial Control

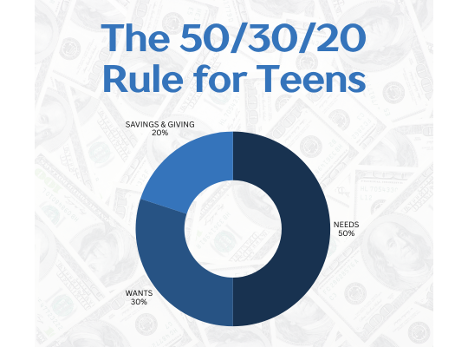

A budget is simply a plan for your money. For a teen, it does not need to be complicated. Introduce them to the 50/30/20 rule as a simple starting framework.

The 50/30/20 Rule for Teens

50 percent for needs

For a teen, this might be fuel for their car or saving for future college expenses.

30 percent for wants

This is for entertainment, eating out, and non-essential purchases.

20 percent for savings and giving

Building an emergency fund and contributing to causes they care about.

Help them set up a basic spreadsheet or use a budgeting app linked to their teen checking account. The goal is to get them into the habit of tracking where their money comes from and where it goes, making them conscious consumers.

The Savings Habit: Pay Yourself First

One of the most powerful concepts in financial literacy is "paying yourself first." As soon as they receive money, whether from a job, a gift, or an allowance, the first action should be to move a portion directly into savings.

Encourage them to set specific, tangible savings goals. "Saving for college" can feel abstract, but "saving 500 dollars for a new gaming console" is motivating. Watching their savings grow in their own account, part of a dedicated youth banking Utah program, provides a tremendous sense of accomplishment and reinforces the positive behavior.

Leading by Example: Your Role as a Financial Mentor

Your teen will learn more from your actions than your words. Be open about your financial decision-making process in an age-appropriate way.

Talk about trade-offs

For example, "We are choosing to spend more on a family vacation this year, so we are eating out less to save for it."

Involve them in planning

Let them help you compare prices at the grocery store or research a major family purchase.

Discuss credit wisely

Explain that a credit card is a tool, not free money, and that debt can be a significant burden if not managed responsibly.

Partner with a Local Bank That Cares

Navigating the world of finance can be daunting for anyone. Having a trusted partner makes all the difference. At Utah Independent Bank, we believe that strong financial literacy begins at home and is supported by a community-focused institution.

Our youth banking Utah initiatives are more than just accounts. They are a commitment to the next generation. We are here to provide the resources, accounts, and friendly guidance to help your teen build confidence and competence with their money.

Take the Next Step Toward Your Teen’s Financial Independence

The journey to financial independence is one of the most valuable gifts you can give your child. By starting the conversation, providing the right tools like a responsible teen checking account, and leading by example, you are not just preparing them to manage their money. You are preparing them to manage their future.

Ready to get started? Visit your local Utah Independent Bank branch or explore our website to learn more about our Teen Checking Account and how we can support your family’s financial journey.

Disclaimer: The views and opinions expressed in this post do not necessarily reflect the official policy or position of Utah Independent Bank. This post is intended for entertainment and/or informational purposes only and should not be construed as financial advice or an endorsement of any product or service.

This article is for educational and informational purposes only and does not constitute financial advice. Product features, fees, and terms may change and may vary by account type or location. Please refer to the official account disclosures and terms provided by the bank for complete and up-to-date details before making any financial decisions.