For many Utahns, tax season brings a welcome boost — that long-awaited refund check. While it may be tempting to splurge on something fun, your tax refund can be a powerful tool for building long-term financial stability. Whether you’re saving for the future, paying down debt, or planning a big purchase, making smart choices with your refund can help you strengthen your financial foundation and reach your goals faster.

At Utah Independent Bank (UIB), we believe every dollar should work as hard as you do. In this post, we’ll share smart, practical ways to use your tax refund to set yourself up for lasting success — from building savings and paying off loans to investing in your future.

Understanding Your Tax Refund: A Financial Opportunity

Your tax refund isn’t “free money” — it’s your money, returned to you. While it might feel like a bonus, think of it instead as a chance to reset and refocus your finances. A few thoughtful decisions can turn a one-time refund into long-term financial growth.

Why It Matters

According to recent data, the average tax refund in the U.S. hovers around $2,800–$3,200. That amount can go a long way toward:

- Strengthening your emergency fund

- Paying down high-interest debt

- Making a significant purchase without financing

- Investing in your home, family, or education

By taking a strategic approach, you can transform your refund into meaningful progress — and UIB’s savings accounts and personal banking tools are designed to help you get there.

Step 1: Start with a Financial Check-Up

Before you decide where your refund should go, take a moment to look at your overall financial picture. This helps you prioritize wisely and avoid spending impulsively.

Questions to Ask Yourself

- Do I have at least three months of living expenses saved?

- Am I carrying high-interest debt (like credit cards or payday loans)?

- Are there upcoming expenses I can plan for now — car repairs, tuition, or family vacations?

- Have I reviewed my budget lately to see where my money is going?

A quick financial planning session — even just reviewing your recent statements — can make your refund decisions more intentional and effective.

If you’re unsure where to start, stop by your local UIB branch. Our team can help you set goals, review account options, and find the right tools for your financial situation.

Step 2: Build or Strengthen Your Emergency Fund

One of the smartest uses for your tax refund is creating (or adding to) an emergency savings account. Unexpected expenses can appear anytime — a medical bill, car repair, or job interruption. Having funds set aside prevents you from turning to credit cards or loans when life throws you a curveball.

How Much Should You Save?

Financial experts recommend saving at least three to six months of living expenses. That might sound overwhelming, but you can start small and build steadily. Even a few hundred dollars can make a big difference in an emergency.

How UIB Can Help

UIB offers savings accounts that are perfect for emergency funds:

- Low minimum balance requirements make it easy to start.

- Competitive interest rates help your money grow safely.

- Online and mobile access allow you to transfer or monitor funds instantly.

💡 Pro Tip: Set up an automatic transfer each month from your UIB checking account to your UIB savings account. You’ll build your emergency fund effortlessly without even noticing it.

Step 3: Pay Down High-Interest Debt

If you’re carrying balances on credit cards or personal loans, your tax refund can help you break free faster. High-interest debt can quietly eat away at your income each month. Paying it down now means less stress, more freedom, and more money available for your future goals.

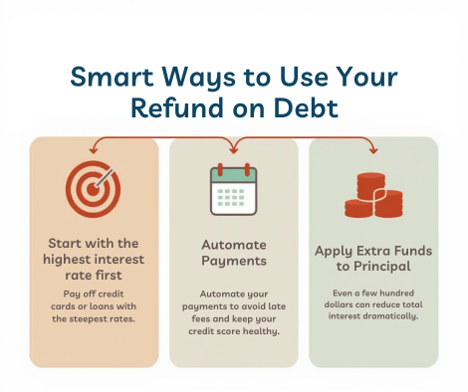

Smart Ways to Use Your Refund on Debt

- Start with the highest interest rate first. Pay off credit cards or loans with the steepest rates.

- Automate payments. Automate your payments to avoid late fees and keep your credit score healthy.

- Make a lump-sum payment. Even a few hundred dollars can reduce total interest dramatically.

- Reassess your budget. Once a debt is paid, redirect that payment amount to savings or another balance

💬 Example:

If you use $1,000 of your refund to pay off a credit card with a 19% APR, you’ll save around $190 in annual interest — just by paying it early.

Step 4: Invest in Your Future

Your tax refund can be a springboard for long-term financial growth. Whether that means investing in education, retirement, or your home, putting the money toward your future can pay dividends for years to come.

Education or Skills Development

Consider using a portion of your refund to take a class, earn a certification, or learn a new skill. Increasing your knowledge often leads to higher earning potential and job stability — a win-win investment.

Retirement Savings

If you already have an emergency fund, think about putting part of your refund into an IRA or other retirement account. Even small contributions can grow significantly over time thanks to compound interest.

Home Improvements

If you own a home, using your refund for maintenance or efficiency upgrades can increase its value and reduce costs. For instance, sealing windows, improving insulation, or upgrading appliances can lower utility bills.

Step 5: Open or Add to a UIB Savings Account

When you deposit your refund into a UIB savings account, you’re not just setting money aside — you’re giving your money the opportunity to grow.

Benefits of UIB Savings Accounts

- Local Service: Decisions and customer care come from real people in your community.

- Safety: All UIB savings accounts are FDIC-insured up to the federal limit.

- Flexibility: Choose from standard savings, money market, or specialized accounts to match your goals.

- Accessibility: Manage funds anytime through online or mobile banking.

A UIB savings account can serve multiple purposes — your emergency fund, vacation savings, or the foundation for a future investment.

Step 6: Start (or Grow) a Family Fund

Family expenses can appear suddenly — from medical costs to school activities. Setting aside part of your tax refund in a designated savings account gives you a cushion for those “just in case” moments.

Practical Family Savings Ideas

- Childcare or education fund: Cover back-to-school costs or extracurricular fees.

- Health fund: Prepare for dental visits, prescriptions, or co-pays.

- Holiday or travel fund: Save early and avoid stress when special occasions come around.

At UIB, you can even set up multiple savings accounts to keep your goals organized. Label each one for its purpose — “Emergency Fund,” “Vacation Fund,” or “Kids’ Expenses” — so you always know where your money stands.

Step 7: Make an Extra Mortgage or Car Payment

If you’re already on top of your budget, another smart move is to make an additional loan payment toward your mortgage, auto loan, or other installment debt.

Why This Works

An extra payment each year can reduce the total interest you’ll pay over the life of the loan — and help you pay it off months or even years sooner.

💡 Example:

Making just one additional mortgage payment per year on a 30-year loan can shave four to six years off your total repayment time. That’s a huge long-term saving with very little short-term sacrifice.

At UIB, we make it easy to apply extra payments directly to your principal, so more of your money goes toward your balance rather than interest.

Step 8: Save for a Future Goal

If your financial basics are covered, use your refund to move closer to a personal or family goal. It might be:

- A down payment on a home

- A family vacation

- Starting a small business or side venture

- Upgrading your vehicle or farm equipment

Setting this money aside in a UIB money market or high-yield savings account allows it to grow while staying accessible when you’re ready to use it.

Step 9: Give Back to the Community

One of the most rewarding ways to use your tax refund is by giving back. Supporting a local cause, nonprofit, or community project helps strengthen the very place where you live and work.

UIB is proud to serve communities across rural Utah, and we see firsthand how generosity creates ripple effects — from supporting schools and 4-H programs to funding community events.

💬 Tip:

Even setting aside 5–10% of your refund for charitable giving can make a big difference locally.

Step 10: Split Your Refund for Multiple Goals

You don’t have to choose just one purpose for your refund. Many UIB customers use a “split strategy” to balance financial priorities.

Here’s an example:

- 40% into a savings account (for emergency fund or goals)

- 30% toward paying down debt

- 20% for upcoming expenses

- 10% for something fun or charitable

This balanced approach lets you be responsible and enjoy your hard-earned refund.

Step 11: Avoid Common Pitfalls

While tax refunds present a great opportunity, there are also mistakes to avoid.

1. Impulse Spending

It’s easy to overspend on nonessentials. Instead, wait 48 hours before making a major purchase. Often, you’ll find the desire fades — and your savings grow.

2. Neglecting High-Interest Debt

Don’t park all your refund in savings while credit card balances accumulate interest. Split the funds strategically to reduce overall costs.

3. Ignoring Future Needs

It’s tempting to enjoy your refund now, but future-you will thank you for saving a portion. Even small deposits into a UIB savings account can add up fast.

Step 12: Build Long-Term Financial Habits

A tax refund is temporary — but smart financial habits last forever. The best way to make your refund count is to use it as the starting point for better money management year-round.

Here’s How to Keep the Momentum Going

- Automate savings: Set up recurring transfers to your UIB savings account.

- Track spending: Use budgeting tools or UIB’s mobile app to stay on top of expenses.

- Review progress quarterly: Check in on your goals every few months and celebrate wins.

- Work with a banker: Our team at UIB can help you fine-tune your financial strategy.

Building steady habits helps ensure that by next tax season, you’re even better prepared — and maybe even earning more interest or carrying less debt.

How UIB Helps You Put Your Refund to Work

At Utah Independent Bank, we understand that personal finance isn’t one-size-fits-all. Our goal is to provide the tools, guidance, and flexibility that help Utahns make the most of every financial opportunity — including tax refunds.

When you bank with UIB, you’ll enjoy:

- Personalized financial guidance from experienced local bankers.

- Savings and money market accounts that help your money grow safely.

- Easy access to funds through online and mobile banking.

- Loan and credit solutions for smarter debt management.

- Community-focused service that puts your needs first.

Whether you’re saving for the future, paying down debt, or planning your next big goal, UIB is here to help you make the most of your tax refund — and every dollar after that.

Final Thoughts

Your tax refund is more than a once-a-year windfall — it’s an opportunity to build financial security, achieve goals, and invest in your future. With thoughtful planning and the right partner by your side, you can turn that check into lasting progress.

At Utah Independent Bank, we’re here to guide you every step of the way — helping you choose the best options for savings, debt reduction, and financial growth.

Visit our UIB Savings Accounts or stop by your nearest branch to discover how UIB can help you save smarter, plan better, and make your money work for you.

Disclaimer: The views and opinions expressed in this post do not necessarily reflect the official policy or position of Utah Independent Bank. This post is intended for entertainment and/or informational purposes only and should not be construed as financial advice or an endorsement of any product or service.

This article is for educational and informational purposes only and does not constitute financial advice. Product features, fees, and terms may change and may vary by account type or location. Please refer to the official account disclosures and terms provided by the bank for complete and up-to-date details before making any financial decisions.